DuPont Stock: Is DD Underperforming the Materials Sector?

With a market cap of $31.9 billion, DuPont de Nemours, Inc. (DD) is a global specialty materials and chemicals company serving electronics, industrial, healthcare, water, and protection markets with well-known brands, like Tyvek and Kevlar. The Wilmington, Delaware-based company is organized into key segments: Electronics & Industrial, Water & Protection, and Corporate & Other, serving customers worldwide.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and DuPont de Nemours fits this criterion perfectly. Its strengths lie in its leading IP, strong margins, and exposure to high-growth markets.

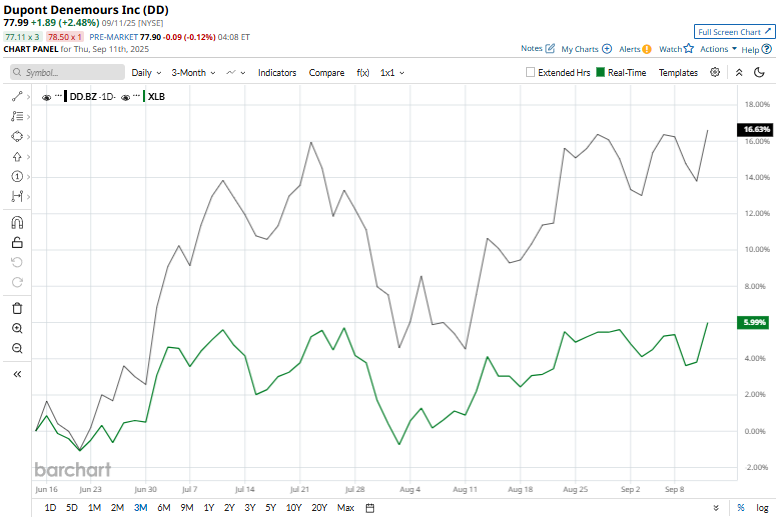

Shares of the chemical titan have declined 13.4% from its 52-week high of $90.06 met on Sept. 27, 2024. Over the past three months, its shares have decreased 12.4%, underperforming the broader Materials Select Sector SPDR Fund's (XLB) 5.2% rise over the same time frame.

Longer term, DD stock is up 2.3% on a YTD basis, lagging behind XLB's 10.1% return. Moreover, shares of DuPont have dipped 2.4% over the past 52 weeks, compared to XLB’s 1.8% rise over the same time frame.

However, the stock has been trading above its 50-day moving average since mid-May and over its 200-day moving average since mid-August, indicating an uptrend.

On Aug. 29, DuPont announced that it had reached a definitive agreement to sell its Aramids business, which includes the well-known Kevlar® and Nomex® brands, to Arclin, a portfolio company of TJC, L.P., in a transaction valued at approximately $1.8 billion. The deal, expected to close in the first quarter of 2026 pending regulatory approvals and customary conditions, will provide DuPont with about $1.2 billion in pre-tax cash proceeds, a $300 million note receivable, and a 17.5% equity stake in the future Arclin entity valued at roughly $325 million at closing.

Management highlighted that the transaction enhances DuPont’s strategic focus, improves its growth and margin profile, and delivers immediate cash proceeds while also giving shareholders exposure to Arclin’s long-term growth potential through the retained equity interest. However, investors were not impressed, and DD shares dipped 1.5% in the next trading session.

Additionally, DD stock has lagged behind rival Linde plc (LIN), which has returned 15.5% YTD and 4% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain highly bullish about its prospects. The stock has a consensus rating of “Strong Buy” from 17 analysts in coverage, and the mean price target of $89.93 represents an upside potential of 15.3% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.