Is Vistra Stock Outperforming the Dow?

Vistra Corp. (VST) is an integrated electricity retailer and power generation company based in Irving, Texas. With a market cap of $70.8 billion, it operates across the U.S., producing and selling power wholesale, and also has retail operations (serving residential, commercial, and industrial customers) under various brands.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks, and Vistra fits this criterion perfectly. It dominates the market through its integrated generation and retail model, which stabilizes earnings across the energy value chain, and its diverse portfolio spanning nuclear, natural gas, coal, solar, and battery storage, ensuring reliability and flexibility.

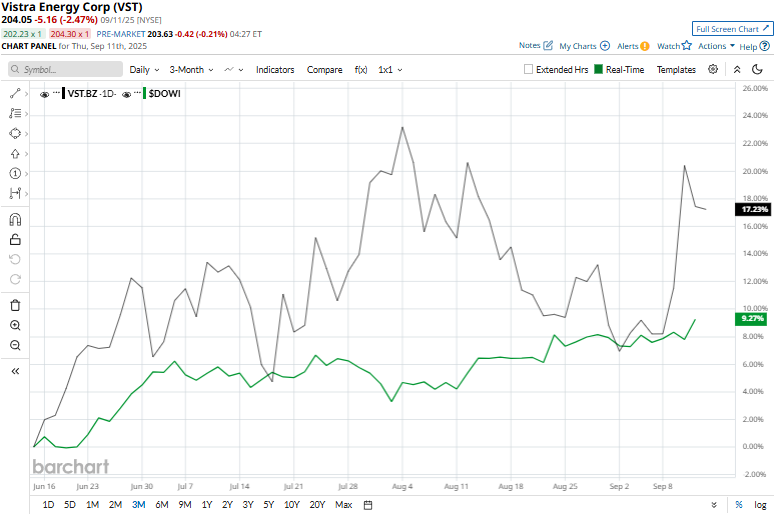

Shares of VST have declined 5.9% from its 52-week high of $216.85. VST stock has increased 22.3% over the past three months, significantly outpacing the broader Dow Jones Industrial Average’s ($DOWI) 7.6% rise during the same time frame.

On a YTD basis, VST stock is up nearly 48%, exceeding $DOWI’s 8.4% gain. Moreover, shares of the utility company have surged 154.9% over the past 52 weeks, compared to $DOWI’s 12.4% return over the same time frame.

The stock has been trading mostly above its 200-day moving average for the past year and has been trading above its 50-day moving average since late April, implying a bullish trend.

On Sept. 10, Vistra shares jumped more than 8%, lifted by a broad rally in power producers amid expectations that surging AI demand will sharply increase electricity consumption. With AI data centers and computing infrastructure requiring vast amounts of power, investors are gravitating toward utilities and generators like Vistra, which is well-positioned to benefit thanks to its expansive and diversified portfolio spanning nuclear, natural gas, and renewable energy assets.

Over the past year, Vistra stock has outperformed its rival NRG Energy, Inc. (NRG), which soared 97.2%. However, in 2025, NRG is up 75%, surpassing VST’s gains.

VST has a consensus rating of “Strong Buy” from 15 analysts in coverage, and the mean price target of $224.86 implies a premium of 10.2% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.