Is Vulcan Materials Stock Outperforming the Nasdaq?

Vulcan Materials Company (VMC), headquartered in Birmingham, Alabama, is the largest producer of construction aggregates in the U.S., specializing in crushed stone, sand, and gravel. The company, valued at $38.9 billion by market cap, operates over 400 facilities across 22 states, as well as in Canada, Mexico, the Bahamas, and the U.S. Virgin Islands.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and Vulcan fits the bill perfectly. It has a strong presence in high-growth regions, particularly the Sun Belt and coastal areas, benefiting from population growth and increased infrastructure development.

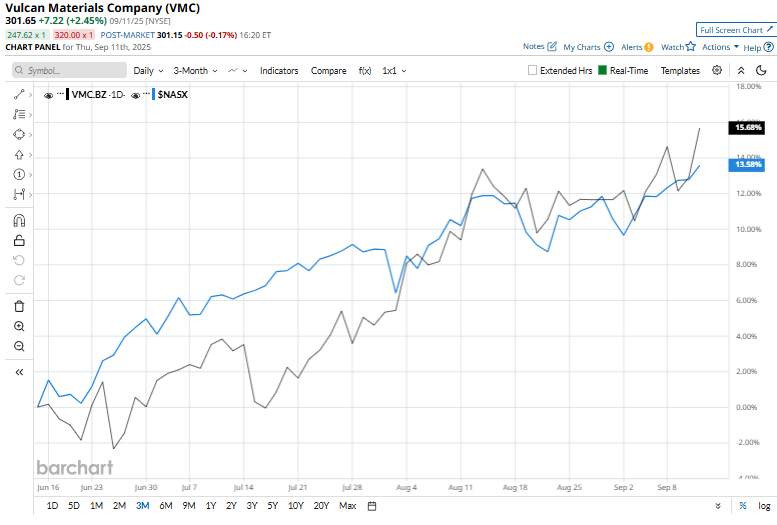

Vulcan stock has demonstrated strong momentum, touching its 52-week high of $302.21 in the last trading session and surging 15.5% over the past three months, outperforming the broader Nasdaq Composite’s ($NASX) 12.4% rise over the same time frame.

Its price action has been impressive in the long term as well. Vulcan’s shares have soared 17.3% in 2025 and 29.5% over the past year, outpacing $NASX’s 14.2% rise on a YTD basis and 26.7% rise over the past year.

To confirm its recent uptrend, VMC stock has been trading over its 50-day and 200-day moving averages since late April.

On Jul. 31, VMC shares rose marginally after reporting its Q2 results. Its adjusted EPS of $2.45 missed Wall Street expectations of $2.55. The company’s revenue was $2.1 billion, which also fell short of Wall Street forecasts of $2.2 billion as weather disruptions slowed construction activity and weighed on demand for its construction materials. Additionally, persistent inflation increased operational costs, and higher borrowing rates dampened overall construction spending, further impacting sales.

However, Vulcan has outpaced its key competitor, Martin Marietta Materials, Inc. (MLM), which has seen a 24.3% rise over the past year.

Among the 22 analysts covering the VMC stock, the consensus rating is a “Strong Buy.” Its mean price target of $307.35 suggests a 1.9% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.