Gartner Stock: Is IT Underperforming the Technology Sector?

/Gartner%2C%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Stamford, Connecticut-based Gartner, Inc. (IT) operates as a research and advisory company. It operates through Research, Conferences, and Consulting segments. With a market cap of $17.6 billion, Gartner’s operations span North America, EMEA, and the Indo-Pacific.

Companies worth $10 billion or more are generally described as "large-cap stocks," and Gartner fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the information technology services industry.

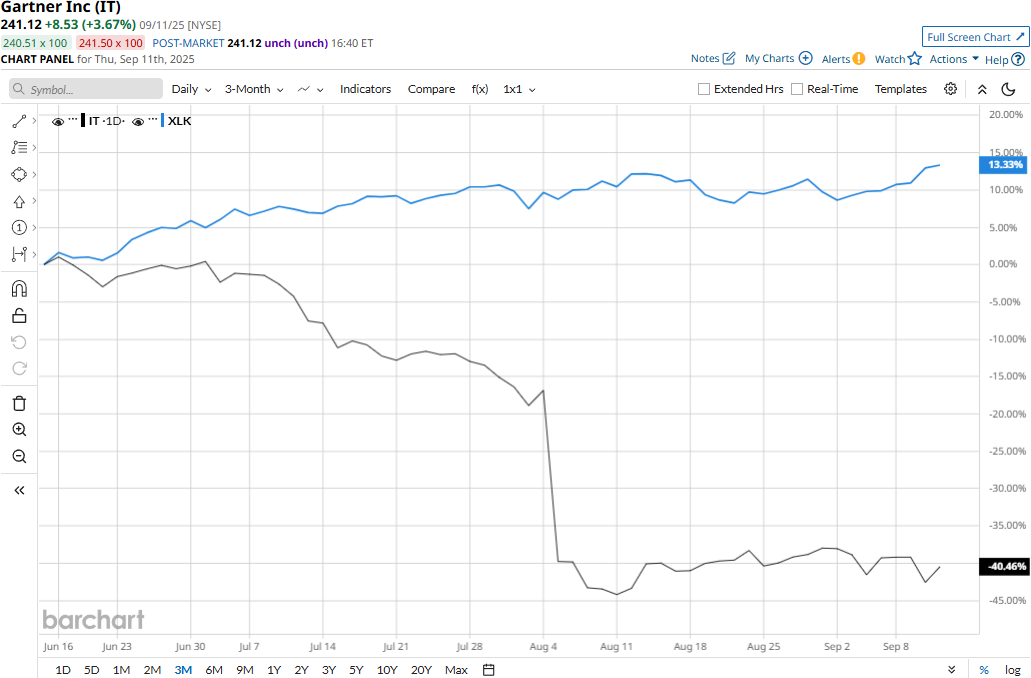

Despite its notable strengths, IT stock prices have plunged 58.7% from its all-time high of $584.01 touched on Feb. 4. Meanwhile, IT stock has declined 41.7% over the past three months, notably underperforming the Technology Select Sector SPDR Fund’s (XLK) 12.8% surge during the same time frame.

Gartner’s performance has remained grim over the longer term as well. Gartner’s stock prices are down 50.2% on a YTD basis and 51.8% over the past year, significantly underperforming XLK’s 16.6% gains in 2025 and 24.6% surge over the past year.

IT stock has traded consistently below its 200-day moving average since early March and mostly below its 50-day moving average since late February, confirming its bearish trend.

In Q2 2025, the company’s revenues for the quarter grew 5.7% year-over-year to $1.7 billion, surpassing the Street’s expectations by a marginal 66 bps. Moreover, its adjusted EPS surged 9.6% year-over-year to $3.53, exceeding the consensus estimates by a notable 4.4%.

However, Gartner’s stock prices plummeted 27.6% following its earnings release on Aug. 5 and remained in the red territory for four subsequent trading sessions. The company significantly reduced its full-year 2025 growth guidance and failed to provide any solid reason for its. Although the management blamed the growth cut on the macro environment, the Street believes Gartner has failed to address the increasing competition in the industry and the threat of AI to its business model.

Meanwhile, Gartner has also underperformed its peer, CDW Corporation’s (CDW) 4.8% decline on a YTD basis and 23.2% plunge over the past year.

Among the 13 analysts covering the IT stock, the consensus rating is a “Moderate Buy.” As of writing, the stock is trading notably below its mean price target of $300.60.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.