Why I’m Setting a ‘No Kings’ Policy for These Overvalued Dividend Stocks

I’m no stranger to analyzing dividend stocks. In fact, once upon a time, I created a valuation factor based on any stock’s dividend yield history, which I trademarked under the name Yield at a Reasonable Price (YARP).

The reason I don’t write on it much these days is that the current, growth-obsessed stock market has left most dividend stocks in a rough patch. Many dividend stocks are not only lagging on total returns, but also have less-competitive payments as a result of the past several years’ events.

The pandemic made it tough on dividend investors for a little while, since the economic climate forced many companies to cut or even eliminate their dividends. Holders of several formerly prominent dividend payers simply saw their reliable quarterly cash flow stop.

Dividend Stocks Are Out of Favor for a Reason

Dividend stocks had a chance to reignite their fan base, but squandered it with persistent weak performance. Not only in share prices, but in responding to how the stock market now operates. Algorithms and indexation, not to mention a flood of younger, newer investors, conspire to make dividend investing one of those things “my parents did.”

The real kicker came in 2022, when the Federal Reserve began to raise interest rates. Although they’re set to come down as soon as next week, bond rates are still at nearly two-decade highs. So to me, investing primarily for the dividend payment a company issues is just not as compelling as it once was.

Oh, and just look at the many articles I’ve written about option collars here. The options market has expanded to the point where if the dividend was some form of safety measure, I see that as inferior to collaring a position, where the worst-case scenario is definable up front. To me, investing is all about controlling what you can. And the worst-case scenario is something we can control with options. Dividend stock price volatility and fundamental growth in earnings? Those are two things completely out of our control.

And that leads me to the Dividend Kings, as they are called. This revered group of stocks have increased their dividend payout for at least 50 straight years.

So to be on the list, a stock would have had to not miss a beat since 1976. That certainly implies these are financially stable stocks. But is that enough in this market? And will it ever be again? More things I can’t control.

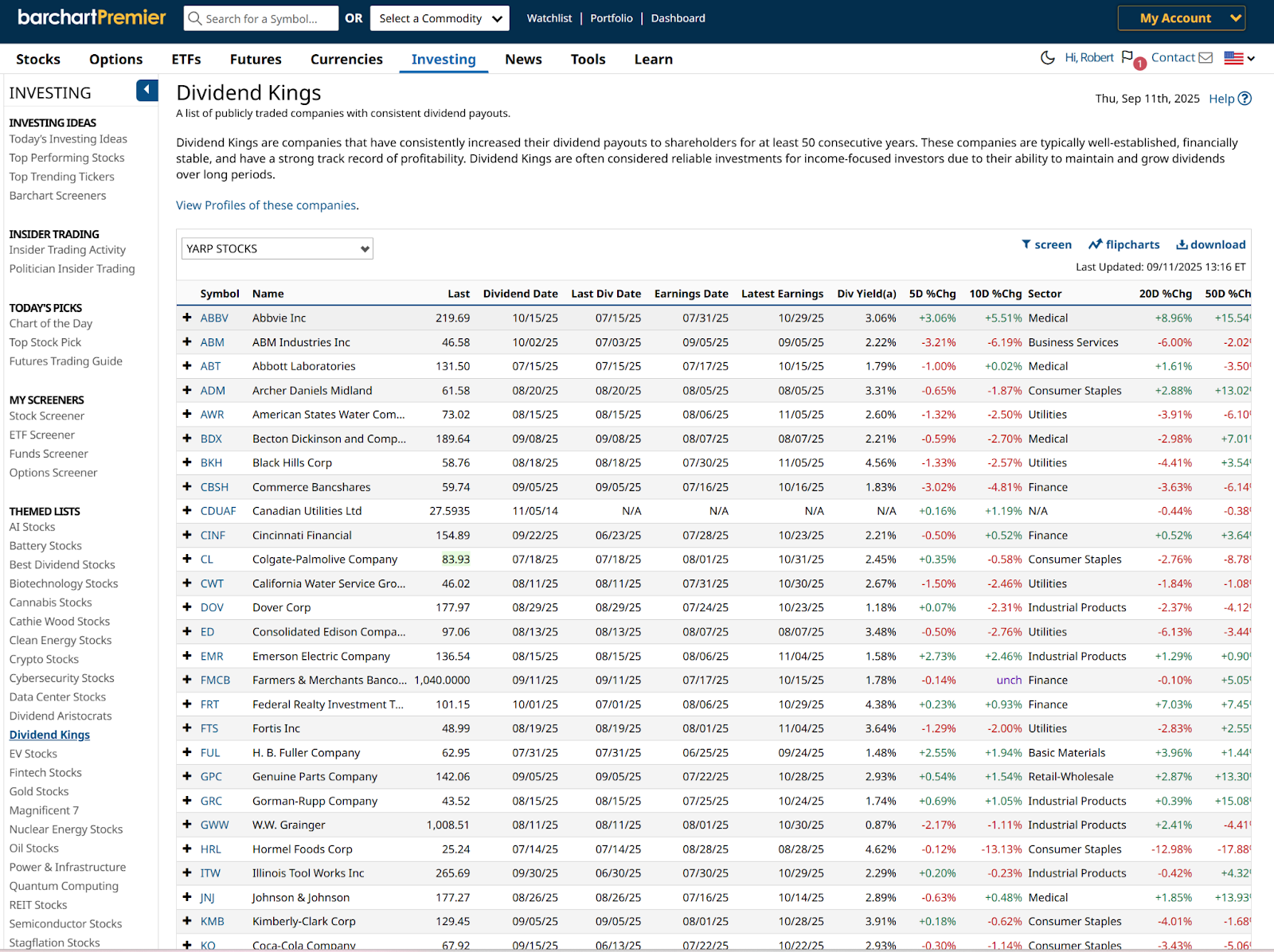

How to Screen for Dividend Kings with Barchart

In a great display of how Barchart saves me time to focus on the more important part of trading and investing – taking action after the research is completed – here is a link to the Dividend Kings list maintained 24/7 at Barchart.com.

And here is a snapshot to give you an idea of what that list contains, applying a custom view I created for YARP-based stock analysis.

That’s a nice list of blue-chip stocks and some smaller, but still high-quality stocks. They wouldn’t be on this list if they were not. But take note: Their average yield is 2.7%. And nearly two-thirds of these stocks yield less than 3%. You know, well below what T-bills have for a few years now.

And in this year of S&P 500 Index ($SPX), Nasdaq-100 Index ($IUXX), Magnificent 7 and AI-stock dominance, the average Dividend Kings stock is up about 4.5% year to date.

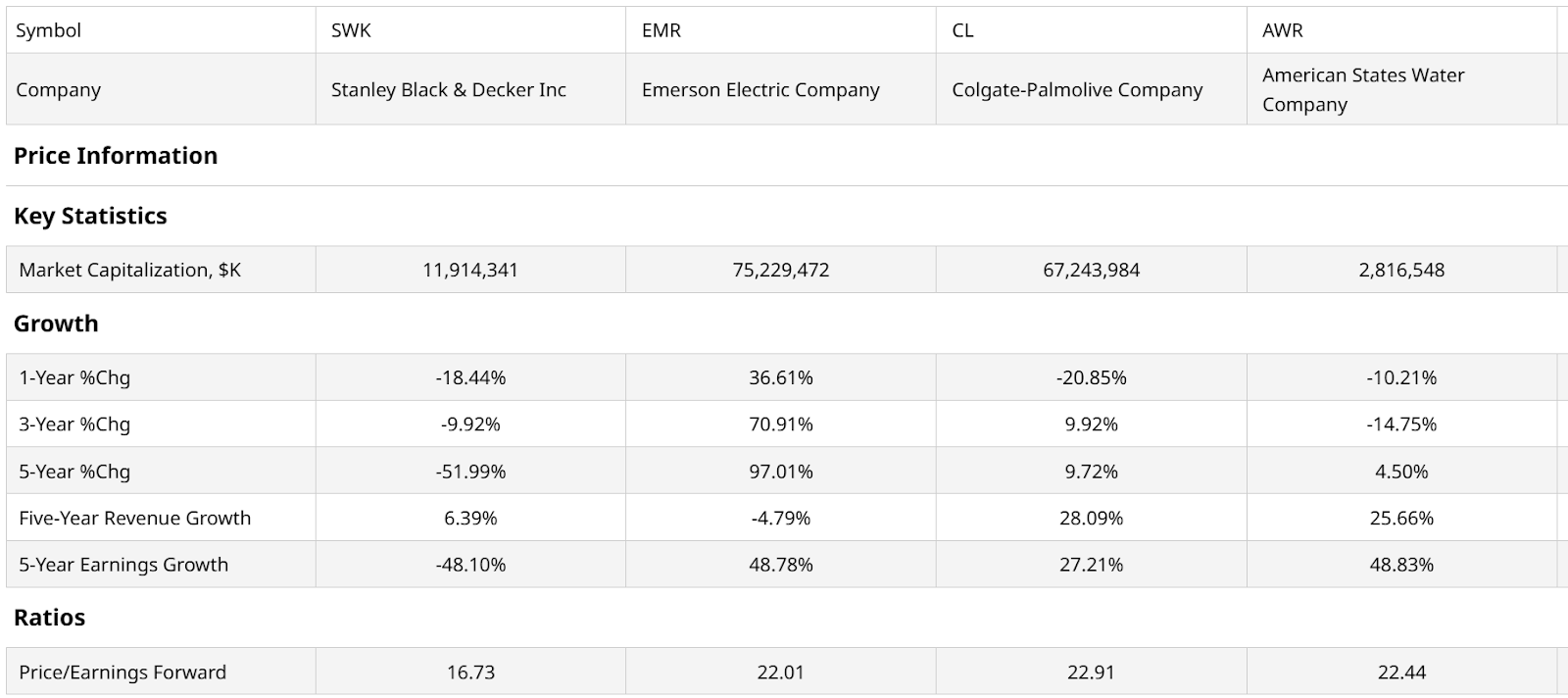

So, what’s there to gain from looking at this list if you are hunting for dividends? I quickly ran through the charts and came up with at least a pair of potentially favorable stocks. And, a pair of very weak stocks that are likely to get weaker. Here’s the four of them, side by side:

Dividend Kings with Strong Chart Patterns

Stanley Black & Decker (SWK) looks like a stock that investors are finally coming back to. It yields 4.2%, putting it in the upper range of the full Dividend Kings list.

Emerson Electric (EMR) is an old classic that might be getting a lift here as well. It yields only 1.5%, though.

Dividend Kings with Weak Chart Patterns

Many to choose from here, but Colgate-Palmolive (CL) stood out. That’s something we don’t say much these days, given the growing irrelevance of the consumer staples sector in a high-growth market. This ain’t that, as they say.

The stock is off more than 20% from its peak set around this time last year. And it yields only 2.5%. This is not one of those cases where dividend holders can claim they will “make it up in volume.”

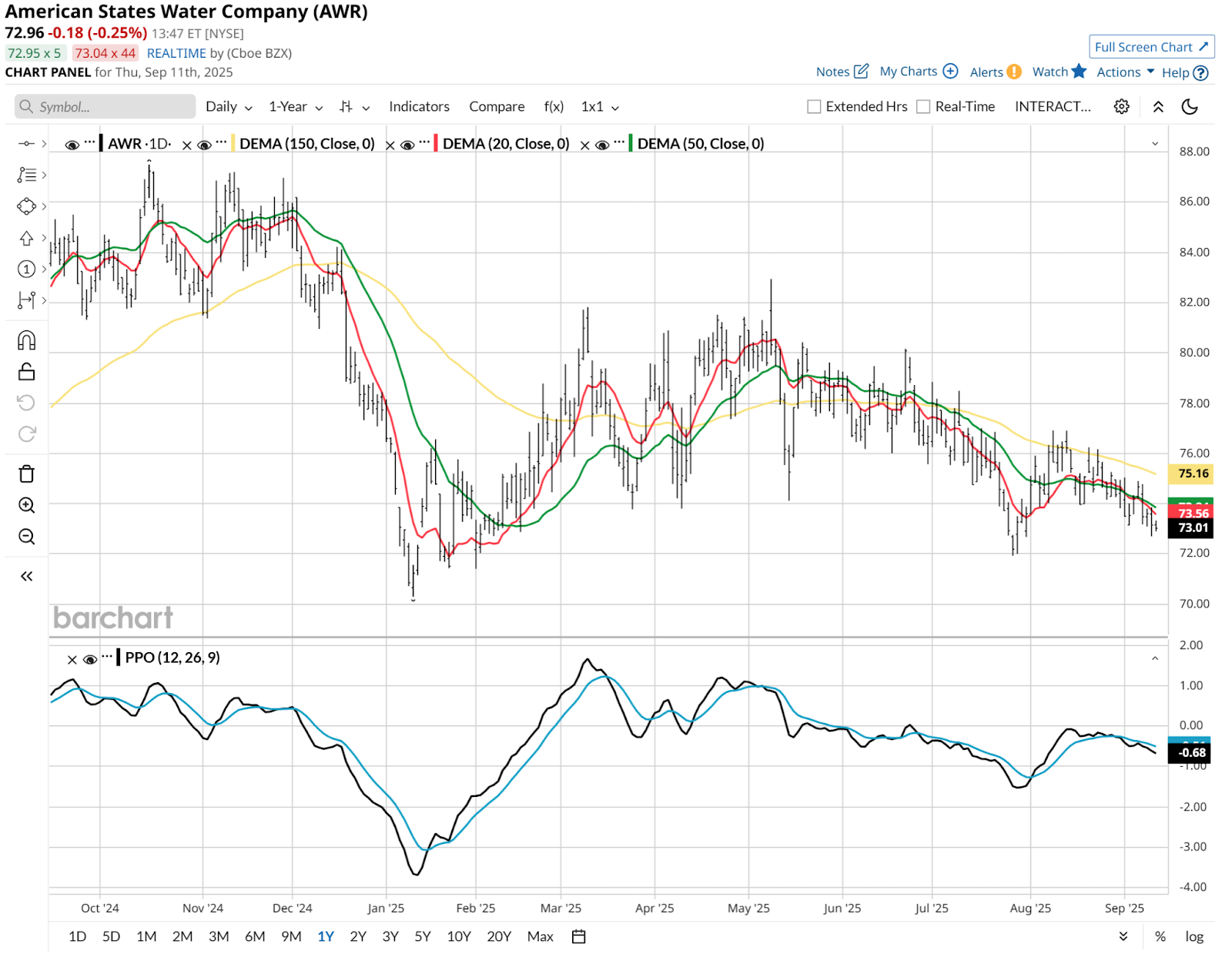

Finally, American States Water (AWR) is a smaller-cap stock with a weak chart. Its yield checks in at 2.8%, and in its many years as a public company, that mark has rarely been north of 4%.

And that’s a quick summary and some samples that leave me with the conclusion that now, as has been the case for years, the Dividend Kings are not an ideal place to hunt for what dividend investors typically want.

The Bottom Line

Investors are much less likely to be impressed by 50 years of dividend growth. These days, they’re looking for higher yields and some lift in a stock price.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.